What Kind Of Expense Is A Subscription . This page outlines the tax treatment of different subscriptions paid by the employer. For computer related purchases and. Learn the basics of business expense,. When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. Accurate expense categorization is crucial for effective financial management and analysis. What is an expense and what classifies as a business expense when filing taxes? There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. For software and other things paid monthly/yearly.

from elinoryusif.blogspot.com

What is an expense and what classifies as a business expense when filing taxes? Accurate expense categorization is crucial for effective financial management and analysis. Learn the basics of business expense,. When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. This page outlines the tax treatment of different subscriptions paid by the employer. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. For software and other things paid monthly/yearly. For computer related purchases and.

25+ use case diagram for expense management system ElinorYusif

What Kind Of Expense Is A Subscription Learn the basics of business expense,. For computer related purchases and. What is an expense and what classifies as a business expense when filing taxes? There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Learn the basics of business expense,. For software and other things paid monthly/yearly. Accurate expense categorization is crucial for effective financial management and analysis. When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. This page outlines the tax treatment of different subscriptions paid by the employer.

From subscriptions-manage-your-regular-expenses.softonic.com.br

Subscriptions Manage your regular expenses para Android Download What Kind Of Expense Is A Subscription When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. This page outlines the tax treatment of different subscriptions paid by the employer. For software and. What Kind Of Expense Is A Subscription.

From www.notion.so

Expenses & Subscriptions Notion Template What Kind Of Expense Is A Subscription For computer related purchases and. For software and other things paid monthly/yearly. What is an expense and what classifies as a business expense when filing taxes? Learn the basics of business expense,. Accurate expense categorization is crucial for effective financial management and analysis. This page outlines the tax treatment of different subscriptions paid by the employer. There is no definitive. What Kind Of Expense Is A Subscription.

From www.d365fandom.com

D365FandO(m) Subscription Billing Expense Deferrals What Kind Of Expense Is A Subscription When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. For software and other things paid monthly/yearly. For computer related purchases and. What is an expense and what classifies as a business expense when filing taxes? Accurate expense categorization is crucial for effective financial management and analysis. Learn the basics of. What Kind Of Expense Is A Subscription.

From notionstack.so

Notion Finance Tracker Track Expenses, Accounts & Subscriptions What Kind Of Expense Is A Subscription When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. For computer related purchases and. What is an expense and what classifies as a business expense when filing taxes? This page outlines the tax treatment of different subscriptions paid by the employer. For software and other things paid monthly/yearly. Accurate expense. What Kind Of Expense Is A Subscription.

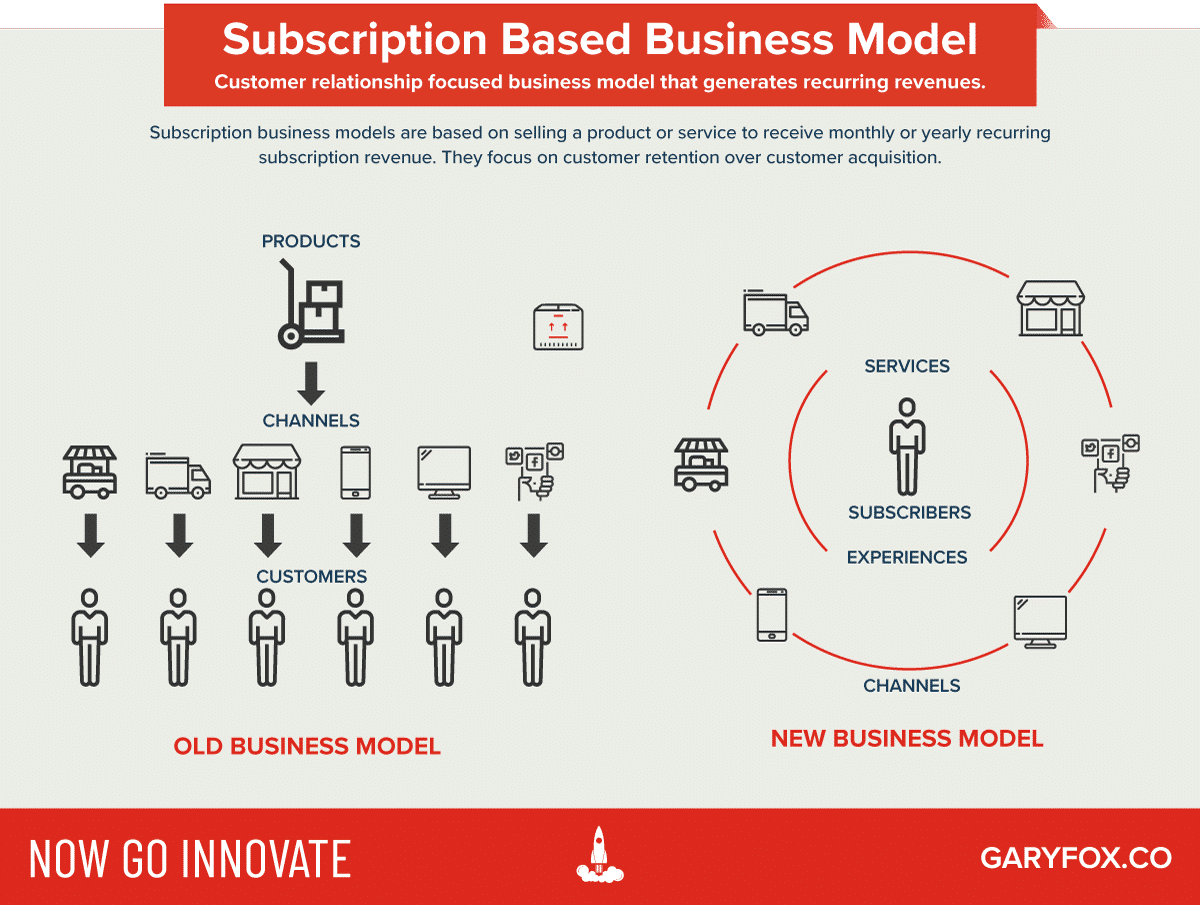

From smartdataweek.com

Subscription Business Model 10 Amazing Industry Examples (2022) What Kind Of Expense Is A Subscription For computer related purchases and. What is an expense and what classifies as a business expense when filing taxes? There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Accurate expense categorization is crucial for effective financial management and analysis. This page outlines the tax. What Kind Of Expense Is A Subscription.

From corporatefinanceinstitute.com

Expenses Definition, Types, and Practical Examples What Kind Of Expense Is A Subscription There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. For computer related purchases and. For software and other things paid monthly/yearly. What is an expense and what classifies as a business expense when filing taxes? When dues and subscriptions are initially paid, they are. What Kind Of Expense Is A Subscription.

From www.vectorstock.com

Expense word lettering Royalty Free Vector Image What Kind Of Expense Is A Subscription When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. Accurate expense categorization is crucial for effective financial management and analysis. For software and other things paid monthly/yearly. Learn the basics of business expense,. What is an expense and what classifies as a business expense when filing taxes? There is no. What Kind Of Expense Is A Subscription.

From www.hotzxgirl.com

Expense Types And Expense Type Categories For Employee Portal Expense What Kind Of Expense Is A Subscription This page outlines the tax treatment of different subscriptions paid by the employer. Accurate expense categorization is crucial for effective financial management and analysis. For software and other things paid monthly/yearly. For computer related purchases and. Learn the basics of business expense,. What is an expense and what classifies as a business expense when filing taxes? When dues and subscriptions. What Kind Of Expense Is A Subscription.

From kdtqt.duytan.edu.vn

Sample Chart of Accounts for a Small Company Góc học tập Khoa Đào What Kind Of Expense Is A Subscription When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. This page outlines the tax treatment of different subscriptions paid by the employer. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Learn the basics. What Kind Of Expense Is A Subscription.

From www.notion.so

Business Expenses Tracker by AnthonyToday Notion Template What Kind Of Expense Is A Subscription For computer related purchases and. This page outlines the tax treatment of different subscriptions paid by the employer. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Learn the basics of business expense,. Accurate expense categorization is crucial for effective financial management and analysis.. What Kind Of Expense Is A Subscription.

From 1investing.in

General and administrative expense — AccountingTools India Dictionary What Kind Of Expense Is A Subscription Accurate expense categorization is crucial for effective financial management and analysis. What is an expense and what classifies as a business expense when filing taxes? When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. This page outlines the tax treatment of different subscriptions paid by the employer. For computer related. What Kind Of Expense Is A Subscription.

From elinoryusif.blogspot.com

25+ use case diagram for expense management system ElinorYusif What Kind Of Expense Is A Subscription Learn the basics of business expense,. For software and other things paid monthly/yearly. What is an expense and what classifies as a business expense when filing taxes? This page outlines the tax treatment of different subscriptions paid by the employer. For computer related purchases and. Accurate expense categorization is crucial for effective financial management and analysis. There is no definitive. What Kind Of Expense Is A Subscription.

From www.aaii.com

Understanding Mutual Fund Fees and Expenses AAII What Kind Of Expense Is A Subscription When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. For software and other things paid monthly/yearly. What is an expense and what classifies as a. What Kind Of Expense Is A Subscription.

From tutorstips.com

What is and Expenditures Account format in Excel & PDF What Kind Of Expense Is A Subscription There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Learn the basics of business expense,. This page outlines the tax treatment of different subscriptions paid by the employer. What is an expense and what classifies as a business expense when filing taxes? Accurate expense. What Kind Of Expense Is A Subscription.

From www.xero.com

Track and Manage Expense Claims Expenses App Xero PH What Kind Of Expense Is A Subscription What is an expense and what classifies as a business expense when filing taxes? This page outlines the tax treatment of different subscriptions paid by the employer. For computer related purchases and. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Learn the basics. What Kind Of Expense Is A Subscription.

From www.whatmommydoes.com

List of Monthly Household Expenses for a Basic Monthly Budget What Kind Of Expense Is A Subscription This page outlines the tax treatment of different subscriptions paid by the employer. For software and other things paid monthly/yearly. There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Accurate expense categorization is crucial for effective financial management and analysis. Learn the basics of. What Kind Of Expense Is A Subscription.

From wealthnation.io

How to Balance Fixed Expenses with Variable Costs Wealth Nation What Kind Of Expense Is A Subscription There is no definitive answer to this question, as the correct expense category for zoom will depend on your business and how you use the. Accurate expense categorization is crucial for effective financial management and analysis. For software and other things paid monthly/yearly. This page outlines the tax treatment of different subscriptions paid by the employer. What is an expense. What Kind Of Expense Is A Subscription.

From accountingplay.com

Prepaid expense Accounting Play What Kind Of Expense Is A Subscription Accurate expense categorization is crucial for effective financial management and analysis. For computer related purchases and. What is an expense and what classifies as a business expense when filing taxes? When dues and subscriptions are initially paid, they are recorded as either prepaid expenses or operating expenses, depending on. There is no definitive answer to this question, as the correct. What Kind Of Expense Is A Subscription.